Wave Accounting is a popular tool for small businesses. It simplifies financial management.

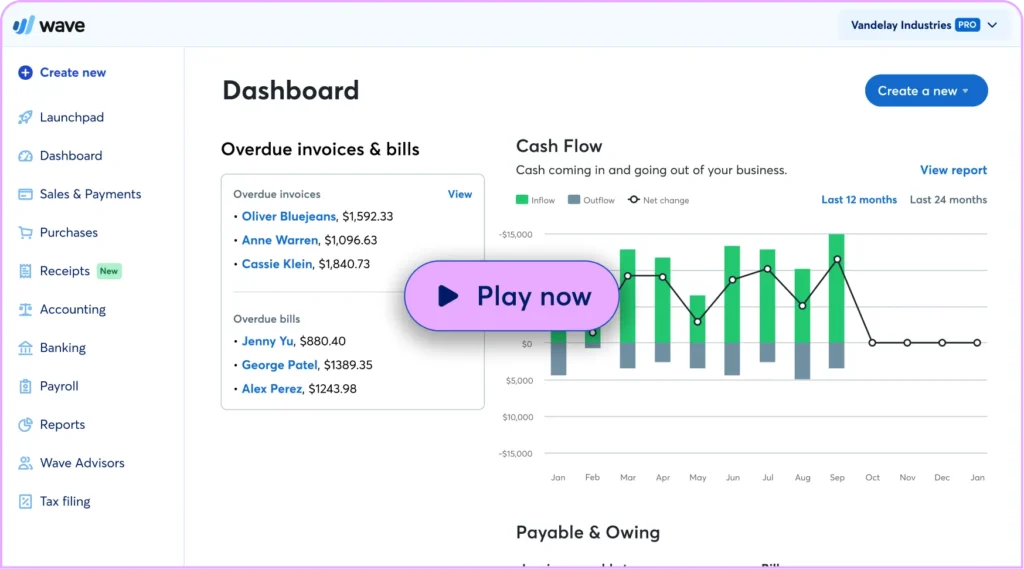

But how does Wave Accounting work? Wave Accounting is designed to streamline your business finances. It offers features like invoicing, expense tracking, and payroll management. The platform is user-friendly and helps you keep your financial data organized. With Wave Accounting, you can generate reports, track payments, and manage receipts all in one place.

It’s free to use, making it accessible for startups and small businesses. Understanding how Wave Accounting works can save you time and reduce stress. Let’s explore the key features and benefits of this powerful accounting tool.

Click Here To Get Promo Code & Full Wave Accounting Review With Extra Bonuses

Credit: solutions.trustradius.com

Introduction To Wave Accounting

Wave Accounting is a popular tool for small businesses and freelancers. It helps manage finances with ease. In this section, we will explore how Wave Accounting works. We will look at its key features and benefits. This will help you understand its value for your business.

What Is Wave Accounting?

Wave Accounting is free accounting software. It is designed for small businesses and freelancers. It offers tools to handle invoices, expenses, and reports. Wave is user-friendly and cloud-based. This means you can access it from anywhere.

Key Features Of Wave

Wave has many features. These features make managing finances simple. Let’s look at some key features.

Invoicing: Create and send professional invoices. Track payments and overdue bills. Set up automatic reminders to get paid faster.

Receipts: Scan and organize receipts easily. Upload receipts using your phone. Match them with transactions for better record-keeping.

Bank Connections: Connect your bank accounts and credit cards. This helps you import transactions automatically. It saves time and reduces errors.

Reports: Generate financial reports with one click. These reports help you understand your business performance. They include profit and loss statements, balance sheets, and more.

Payroll: Manage payroll for your employees. Calculate taxes and deductions automatically. Ensure compliance with local regulations.

Wave Accounting offers other features too. These include expense tracking, tax calculations, and more. All of these features help you manage your business finances effectively.

Setting Up Your Account

Setting up your Wave Accounting account is the first step to managing your finances. This process involves creating an account and configuring your business settings. Follow these simple steps to get started quickly.

Creating An Account

Begin by visiting the Wave Accounting website. Click on the “Sign Up” button. Enter your email address and create a strong password. Alternatively, sign up using your Google account. After that, you will receive a verification email. Click the link in the email to verify your account.

Configuring Business Settings

Once your account is verified, log in to your Wave dashboard. Click on the “Settings” tab in the menu. Here, you can enter your business name and contact details. Choose your business type and industry. This helps Wave tailor its features to your needs.

Next, set up your currency and time zone. Accurate settings ensure your financial data is correct. Finally, connect your bank accounts and credit cards. This allows Wave to import your transactions automatically.

Managing Invoices

Wave Accounting simplifies managing invoices, making it easy for business owners. This section covers creating invoices and tracking payments. Understanding these processes ensures smooth business operations.

Creating Invoices

Wave Accounting allows easy creation of professional invoices. Start by clicking the ‘Create Invoice’ button. Add customer details, service descriptions, and amounts. Customize the invoice template to match your brand.

Review the invoice before sending. Ensure all details are correct. Send the invoice directly via email from Wave. The system will notify you when the client views the invoice.

Tracking Payments

Wave Accounting tracks payments seamlessly. Once the invoice is sent, you can monitor its status. The system shows whether the invoice is viewed, paid, or overdue.

When a client pays, Wave updates the invoice status. It automatically records the payment in your accounting records. This helps you stay organized and manage cash flow effectively.

Wave also sends reminders for overdue invoices. This feature reduces the chances of missed payments. Ensuring timely payments is crucial for business stability.

Credit: www.waveapps.com

Expense Tracking

Expense tracking is an essential part of managing your finances. Wave Accounting makes it easy to keep track of your expenses. This helps you understand where your money goes and stay on top of your budget. In this section, we will explore how Wave Accounting helps with recording expenses and categorizing transactions.

Recording Expenses

Wave Accounting offers several ways to record your expenses. You can manually enter each expense into the system. This is useful if you have paper receipts or cash expenses. Wave also allows you to connect your bank account. This way, your expenses are imported automatically. You can also upload receipts by taking a photo with your phone. Wave will extract the necessary details from the receipt.

Categorizing Transactions

Categorizing your transactions is important for accurate financial reports. Wave Accounting automatically suggests categories for your expenses. This saves you time and ensures consistency. You can also create custom categories that suit your business needs. Reviewing and adjusting categories is simple. This ensures that your expenses are correctly categorized.

Bank Reconciliation

Bank reconciliation in Wave Accounting ensures that your financial records match your bank statements. This process helps maintain accurate financial data. It also identifies discrepancies and errors early on. The process is straightforward and user-friendly.

Connecting Bank Accounts

Connecting your bank accounts to Wave is simple. Go to the Banking section. Then select “Connect a Bank Account.” Follow the prompts to link your bank. This connection allows Wave to import transactions automatically. This saves time and reduces manual entry errors.

Reconciling Transactions

Once your bank account is connected, Wave will import transactions. You can then categorize these transactions. Match them with your records. To reconcile, compare the transactions in Wave with your bank statement. Look for any discrepancies. Correct any mismatches you find. This ensures your records are accurate.

Wave provides tools to help with reconciliation. You can mark transactions as reviewed. This helps track which items you have checked. Wave also allows you to add manual transactions. This is useful for cash payments or checks that haven’t cleared yet.

Regular reconciliation keeps your accounts up to date. It helps you spot errors quickly. It also provides a clear financial picture. Wave makes this process easy and efficient.

Financial Reporting

Financial Reporting is a crucial aspect of managing your business’s financial health. Wave Accounting simplifies this process by offering a range of easy-to-generate reports. These reports help you understand your financial status and make informed decisions.

Generating Reports

Wave Accounting allows you to create various financial reports with just a few clicks. These include:

- Profit and Loss Statement

- Balance Sheet

- Cash Flow Statement

To generate a report, navigate to the ‘Reports’ section in your dashboard. Select the type of report you need. Customize the date range and other parameters. Click ‘Generate Report’ to view your data.

Interpreting Data

Once the report is generated, it is essential to interpret the data correctly. Here’s a brief guide:

- Profit and Loss Statement: Shows your income and expenses. Helps you understand your profitability.

- Balance Sheet: Provides a snapshot of your assets, liabilities, and equity. It helps you assess your financial stability.

- Cash Flow Statement: Tracks the flow of cash in and out. It helps you manage liquidity.

Understanding these reports enables you to spot trends, identify areas for improvement, and plan for the future.

Payroll Management

Payroll Management is a critical part of any business. Wave Accounting makes it easy to manage. It ensures your employees get paid on time. Wave’s payroll features are user-friendly and efficient.

Setting Up Payroll

First, set up your payroll account in Wave. Enter your company details. Include business name, address, and contact information. Next, add your bank details. This allows Wave to process payments. Finally, enter your tax information. This ensures proper tax calculations.

Managing Employee Payments

Managing employee payments in Wave is straightforward. First, add your employees’ information. Include their names, job titles, and payment details. You can set up direct deposit for easy payments. Wave calculates the payroll taxes automatically. Generate payslips easily. Review and approve payments before processing. Track payment history for your records.

Credit: www.accountsjunction.com

Wave Mobile App

The Wave Mobile App is a powerful tool designed for small business owners. It allows you to manage your accounting tasks while on the go. With this app, you can handle your finances anytime, anywhere.

Features Of The Mobile App

The Wave Mobile App comes packed with several essential features:

- Invoicing: Create and send professional invoices from your phone.

- Expense Tracking: Track your expenses by snapping photos of receipts.

- Real-time Updates: Sync data across all your devices instantly.

- Cash Flow Management: Monitor your cash flow with ease.

- Multi-Currency Support: Handle multiple currencies effortlessly.

Using The App For On-the-go Accounting

Managing your finances on the move has never been easier:

- Download the App: The Wave Mobile App is available on both iOS and Android.

- Log In: Use your existing Wave account credentials to log in.

- Create Invoices: Generate invoices quickly and send them to clients.

- Track Expenses: Capture receipts using your phone’s camera.

- Sync Data: All your data syncs automatically with your Wave account.

The Wave Mobile App ensures you stay on top of your accounting. Whether you are at a coffee shop, traveling, or working from home, your finances are always at your fingertips. This seamless integration helps you maintain accurate records and make informed financial decisions.

Customer Support And Resources

Wave Accounting offers valuable customer support and resources. These ensure users can make the most of the platform. Whether you’re new to Wave or have been using it for a while, there are various ways to get help and learn more.

Accessing Support

Wave provides multiple support options. Users can access the Help Center for common questions. The Help Center is a collection of articles and guides. It covers many topics about using Wave. If you need more help, you can submit a support request. Wave’s team will assist you via email. They aim to respond quickly and offer clear solutions.

Utilizing Wave’s Learning Resources

Wave also offers learning resources to help users. These include webinars, tutorials, and user guides. Webinars are live sessions where you can learn from experts. Tutorials offer step-by-step instructions on various tasks. User guides provide detailed information on features and functions. These resources help users gain confidence and knowledge.

Frequently Asked Questions

What Is Wave Accounting?

Wave Accounting is a free, cloud-based accounting software. It helps small businesses manage their finances.

How Do I Sign Up For Wave Accounting?

To sign up, visit Wave’s website and click “Sign Up”. Follow the prompts to create your account.

Is Wave Accounting Really Free?

Yes, Wave Accounting is free. There are no hidden charges for its core features.

Can Wave Accounting Generate Invoices?

Yes, Wave Accounting allows you to create and send professional invoices. You can customize them as needed.

Conclusion

Wave Accounting offers a simple, user-friendly solution for small businesses. Its features streamline financial tasks, making management easier. From invoicing to expense tracking, Wave covers essential needs. It integrates well, saving time and reducing stress. The best part? It’s free, which is a great advantage for budget-conscious entrepreneurs.

Wave Accounting helps keep your business finances organized, so you can focus on growth. Try it and see the benefits for yourself. Embrace the ease and efficiency Wave brings to your business.