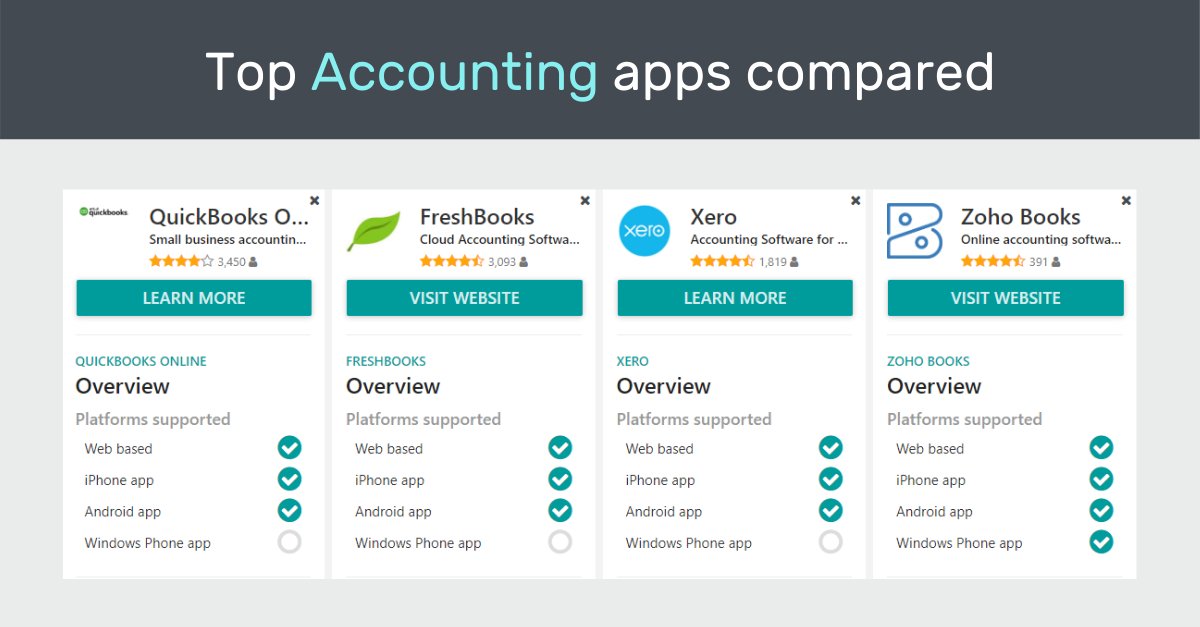

Choosing the right accounting software can be challenging. Freshbooks, Zoho, and Xero are three popular options.

Each has unique features and benefits. In today’s digital world, efficient accounting software is vital for businesses. Freshbooks, Zoho, and Xero offer robust solutions, but which one suits your needs best? Comparing these platforms helps you understand their strengths and weaknesses.

This guide will explore key aspects of each software, aiding your decision-making process. By examining features, pricing, and user experience, you’ll gain clarity on which option aligns with your business goals. Let’s dive in and discover what Freshbooks, Zoho, and Xero bring to the table.

Click Here To Get Promo Code & Full Accounting Software Review With Extra Bonuses

Credit: fastlane-global.com

Freshbooks Overview

FreshBooks is a popular accounting software designed for small businesses. It simplifies tasks like invoicing, time tracking, and expense management. FreshBooks is known for its user-friendly interface. It helps small business owners manage their finances with ease.

Key Features

- Invoicing: Create professional invoices in minutes. Customize them with your logo and colors.

- Expense Tracking: Easily track and categorize expenses. Attach receipts to each expense.

- Time Tracking: Track time spent on projects. Convert tracked hours into invoices.

- Reports: Generate detailed financial reports. Gain insights into your business performance.

- Multi-Currency Support: Invoice clients in their currency. Avoid conversion issues.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Credit: m.youtube.com

Zoho Books Overview

Zoho Books offers robust accounting features, making it a strong contender against Freshbooks and Xero. It provides comprehensive invoicing, expense tracking, and financial reporting tools. Suitable for small businesses seeking an easy-to-use solution.

Zoho Books is a robust accounting software designed for small businesses. It offers a wide range of features that simplify financial management. Zoho Books helps manage invoices, expenses, and inventory. It also provides tools for tax compliance and financial reporting.

Zoho Books is popular for its user-friendly interface and affordability. It integrates well with other Zoho products and third-party apps. This makes it a flexible choice for growing businesses.

Key Features

Zoho Books offers automated banking. You can sync your bank accounts for real-time updates. It provides multi-currency support, which is great for global businesses.

The software includes time tracking. This feature is useful for billing clients accurately. It also offers project management tools. You can track project expenses and profits easily.

Zoho Books provides a client portal. This allows clients to view and pay invoices online. The software supports recurring invoices and payments. This is ideal for subscription-based services.

Pros And Cons

Zoho Books has many advantages. It is affordable, even for small businesses. The user interface is intuitive and easy to navigate. It offers strong integration with other Zoho apps.

However, Zoho Books has some limitations. The inventory management features are basic. Some users find the customization options limited. The mobile app lacks some desktop features.

Zoho Books is a solid choice for small businesses. It offers essential accounting tools at an affordable price. Its integration capabilities and user-friendly design make it popular.

“`

Xero Overview

Xero is a popular cloud-based accounting software designed for small and medium businesses. It offers a range of features that simplify financial management. This tool helps users manage invoices, bank reconciliations, and payroll, among other tasks. Xero aims to streamline accounting processes and improve financial visibility.

Key Features

Xero provides a user-friendly dashboard. This feature allows quick access to key financial data. Users can connect their bank accounts, enabling automatic transaction imports. Invoicing is simple, with options for customization and online payment integration. The software supports multiple currencies. It also offers detailed financial reporting. Payroll management is another strong point. Users can manage employee payments and track leave easily.

Pros And Cons

Xero has several advantages. It is easy to use. The interface is clean and intuitive. The software integrates with numerous third-party apps. This enhances its functionality. Xero’s customer support is responsive and helpful. Users can access the platform from any device with internet.

However, Xero has some drawbacks. The pricing can be high for small businesses. Some features require additional fees. Users may find the initial setup time-consuming. The learning curve can be steep for beginners. Despite these cons, Xero remains a strong choice for many businesses.

Pricing Comparison

Choosing the right accounting software often comes down to pricing. FreshBooks, Zoho Books, and Xero offer different plans. Understanding the costs can help you decide which one fits your budget. Let’s break down the pricing for each of these platforms.

Freshbooks Pricing

FreshBooks has four pricing plans. The Lite plan starts at $15 per month. This plan is suitable for freelancers. The Plus plan costs $25 per month. It offers more features for small businesses. The Premium plan is $50 per month. It’s best for growing businesses. FreshBooks also offers a Select plan. This plan has custom pricing for large businesses. Each plan comes with a 30-day free trial.

Zoho Books Pricing

Zoho Books provides flexible pricing. The Basic plan is $20 per month. It includes all essential features. The Standard plan costs $50 per month. This plan is for growing businesses. The Professional plan is $70 per month. It includes advanced features. Zoho Books also offers a 14-day free trial. You can test the software before committing.

Xero Pricing

Xero has three pricing tiers. The Early plan starts at $13 per month. It is good for new businesses. The Growing plan costs $37 per month. This plan is for small businesses with more needs. The Established plan is $70 per month. It offers the most features. Xero provides a 30-day free trial for all plans. This helps you to explore the software before buying.

User Interface And Experience

The user interface and experience of accounting software are crucial. It affects how easily users can navigate and complete tasks. Let’s compare the user interfaces and experiences of FreshBooks, Zoho, and Xero.

Ease Of Use

FreshBooks has a clean and intuitive design. Users often praise its simplicity. It is easy to navigate and understand. This makes it great for small business owners.

Zoho offers a more complex interface. It might take some time to get used to. However, it has many features. Advanced users might find it powerful.

Xero strikes a balance between the two. Its interface is modern and user-friendly. It is also feature-rich. Users find it easy to use after a short learning curve.

| Software | Ease of Use |

|---|---|

| FreshBooks | Simple and intuitive |

| Zoho | Feature-rich but complex |

| Xero | Modern and balanced |

Customer Support

FreshBooks offers 24/7 support through phone and email. Many users appreciate their quick and helpful responses. Their support team is known to be friendly.

Zoho provides support via phone, email, and chat. Their support is available during business hours. Users have mixed reviews about their response time.

Xero offers support through email and their online community. They do not offer phone support. Users can find helpful articles and guides on their website.

| Software | Customer Support |

|---|---|

| FreshBooks | 24/7 phone and email support |

| Zoho | Phone, email, and chat during business hours |

| Xero | Email and online community support |

Credit: x.com

Integration Capabilities

Choosing the right accounting software goes beyond basic functionalities. Integration capabilities play a significant role in ensuring seamless workflows. FreshBooks, Zoho Books, and Xero each offer distinct integrations with various applications. These integrations can enhance productivity and improve business operations.

Freshbooks Integrations

FreshBooks supports a wide range of integrations to streamline your business processes. Some popular integrations include:

- Payment Gateways: Stripe, PayPal

- CRM Tools: HubSpot, Salesforce

- Project Management: Trello, Asana

- Communication: Slack, Zoom

These integrations enable you to manage invoices, customer relationships, and projects efficiently. The ease of connecting FreshBooks with other applications enhances its functionality.

Zoho Books Integrations

Zoho Books offers various integrations to support different business needs. Key integrations include:

| Category | Integrations |

|---|---|

| Payment Gateways | PayPal, Stripe |

| CRM | Zoho CRM, Salesforce |

| Email Marketing | Mailchimp, Zoho Campaigns |

| eCommerce | Shopify, WooCommerce |

With these integrations, Zoho Books offers a comprehensive solution for managing sales, marketing, and finance.

Xero Integrations

Xero boasts a vast marketplace with over 800 integrations. Some noteworthy integrations include:

- Payroll: Gusto, Square Payroll

- Inventory Management: DEAR Inventory, TradeGecko

- Bank Feeds: Plaid, Yodlee

- POS Systems: Vend, Square

These integrations make Xero a versatile tool for various business activities. The extensive range of integrations ensures that businesses can tailor Xero to their specific needs.

Mobile App Performance

In the world of accounting software, mobile app performance plays a crucial role. Business owners need to manage finances on the go. Let’s compare the mobile apps of FreshBooks, Zoho Books, and Xero.

Freshbooks Mobile App

The FreshBooks mobile app is known for its user-friendly interface. It allows you to create invoices, capture expenses, and track time effortlessly. Users appreciate its clean design and smooth navigation.

- Pros:

- Intuitive layout

- Easy expense tracking

- Time tracking feature

- Cons:

- Limited report customization

- Occasional sync issues

Zoho Books Mobile App

The Zoho Books mobile app offers a robust set of features. It supports sales orders, purchase orders, and even inventory management. The app is reliable and performs well under heavy usage.

- Pros:

- Comprehensive features

- Good for inventory management

- Stable performance

- Cons:

- Complex for new users

- Occasional slowdowns

Xero Mobile App

The Xero mobile app focuses on ease of use and functionality. It allows users to reconcile bank transactions, send invoices, and monitor cash flow. The app is praised for its seamless integration with the web version.

- Pros:

- Easy bank reconciliation

- Real-time cash flow monitoring

- Good integration with web

- Cons:

- Limited offline capabilities

- Invoicing features can be improved

Security And Data Privacy

Security and data privacy are critical when choosing accounting software. Freshbooks, Zoho, and Xero all prioritize keeping your data safe. Let’s compare their security features.

Data Encryption

Each platform uses advanced encryption to protect your data.

- Freshbooks: Uses 256-bit SSL encryption. This is the same level of encryption used by banks.

- Zoho: Implements AES-256 encryption. All data transmissions are secure.

- Xero: Employs 256-bit SSL encryption. Ensures data safety during transfer.

Compliance

Compliance with industry standards is crucial for data protection.

| Software | Compliance Standards |

|---|---|

| Freshbooks | PCI DSS compliant. SOC 2 Type II certified. |

| Zoho | ISO 27001 certified. SOC 2 Type II certified. |

| Xero | ISO 27001 certified. SOC 2 Type II certified. |

All three platforms adhere to top industry standards. They ensure your data is handled responsibly and securely.

Final Verdict

Choosing the right accounting software can be challenging. FreshBooks, Zoho Books, and Xero each have their strengths. This final verdict will help you decide which is best for your business.

Best For Small Businesses

FreshBooks shines for small businesses. Its user-friendly interface makes it easy to navigate. Small business owners will appreciate its invoicing and time-tracking features. FreshBooks also offers excellent customer support. This can be crucial for those with limited accounting knowledge.

Best For Large Enterprises

Zoho Books stands out for large enterprises. It offers a wide range of features. These include inventory management and multi-currency support. Zoho Books integrates well with other Zoho apps. This makes it suitable for complex business needs. Additionally, its pricing plans are scalable. This ensures that as your business grows, Zoho Books can keep up.

Xero is also a strong contender for large enterprises. Its robust reporting tools are beneficial for large-scale operations. Xero supports numerous third-party integrations. This enhances its functionality. It also offers unlimited users. This feature is vital for large teams needing access to financial data.

Frequently Asked Questions

What Are The Main Features Of Freshbooks?

FreshBooks offers time tracking, invoicing, expense management, and project management. It also includes customizable reports and multi-currency support. These features are designed to simplify accounting for small businesses and freelancers.

How Does Zoho Books Integrate With Other Tools?

Zoho Books integrates seamlessly with other Zoho apps and third-party tools. These include CRM, inventory management, and payment gateways. This allows for smooth workflow automation and data synchronization.

Is Xero Suitable For Small Businesses?

Yes, Xero is ideal for small businesses. It offers invoicing, bank reconciliation, and expense tracking. Additionally, it provides real-time financial reporting and integrates with many third-party apps.

Which Accounting Software Is The Easiest To Use?

FreshBooks is known for its user-friendly interface. It simplifies accounting tasks for small business owners and freelancers. The platform offers a straightforward setup and intuitive navigation.

Conclusion

Choosing the right accounting software depends on your business needs. FreshBooks offers user-friendly invoicing. Zoho provides extensive features at a budget-friendly price. Xero excels in integrations and scalability. Each has its strengths. Evaluate your priorities. Consider ease of use, features, and cost.

Make an informed decision. Your business will benefit from the right choice. Happy accounting!