Yes, Zoho Books offers payroll features. It integrates with Zoho Payroll for seamless payroll management.

Managing finances can be tricky for small businesses. You need tools that simplify these tasks. Zoho Books is a popular choice for accounting software. But does it handle payroll too? Payroll is crucial. It ensures your employees get paid on time and correctly.

Integrating payroll with accounting software can save time and reduce errors. In this blog, we explore if Zoho Books has payroll capabilities. We will look at how it integrates with Zoho Payroll and what benefits this offers. This will help you decide if Zoho Books meets your business needs. Stay tuned to learn more!

Click Here To Get Promo Code & Full Zoho Books Review With Extra Bonuses

Introduction To Zoho Books

Zoho Books simplifies accounting tasks for businesses. It includes payroll management to streamline employee payments. This feature ensures accurate and timely salary processing.

Zoho Books is a cloud-based accounting software designed for small businesses. It helps streamline financial operations and manage finances effectively. Zoho Books is known for its user-friendly interface and robust features. This makes it a popular choice for business owners.

What Is Zoho Books?

Zoho Books is an online accounting platform. It offers tools for managing finances, invoicing, and inventory. It simplifies accounting tasks and ensures compliance with tax regulations. Business owners can easily track expenses, create invoices, and monitor cash flow.

Core Features Of Zoho Books

Zoho Books offers a variety of features to manage your business finances. Here are some core features:

- Invoicing: Create and send professional invoices to clients.

- Expense Tracking: Record and categorize expenses for better financial management.

- Bank Reconciliation: Match your bank statements with transactions in Zoho Books.

- Inventory Management: Keep track of stock levels and manage inventory efficiently.

- Time Tracking: Track billable hours and manage timesheets.

- Tax Compliance: Ensure your business complies with tax regulations.

| Feature | Description |

|---|---|

| Invoicing | Create and send professional invoices. |

| Expense Tracking | Record and categorize expenses. |

| Bank Reconciliation | Match bank statements with transactions. |

| Inventory Management | Track stock levels and manage inventory. |

| Time Tracking | Track billable hours and manage timesheets. |

| Tax Compliance | Ensure compliance with tax regulations. |

Zoho Books integrates with various payment gateways. This allows seamless payment processing. It also supports multi-currency transactions. This feature is beneficial for businesses with international clients. Zoho Books also offers mobile apps for iOS and Android. These apps allow business owners to manage finances on the go.

“`

Credit: www.zoho.com

Payroll In Zoho Books

Zoho Books is an excellent accounting tool for small businesses. But does it offer payroll features? Let’s explore this essential aspect of business management in Zoho Books.

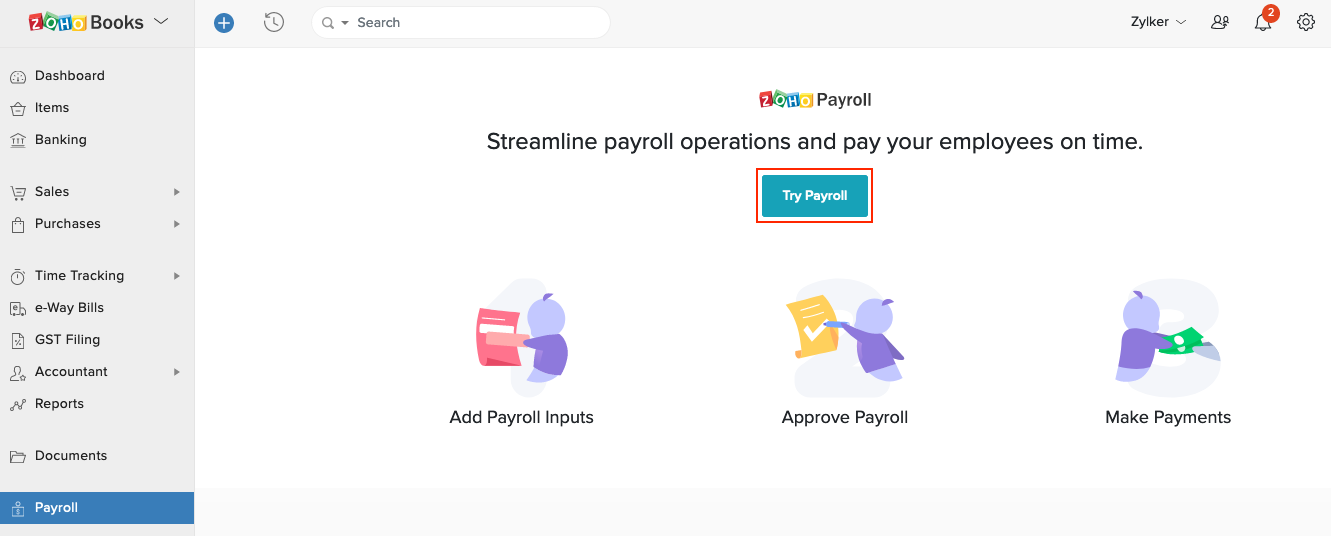

Availability Of Payroll Feature

Zoho Books integrates with Zoho Payroll to offer seamless payroll management. This integration helps businesses manage employee salaries, deductions, and taxes. Zoho Payroll ensures compliance with local regulations.

Businesses can automate salary calculations and disbursements. This reduces manual errors and saves time. The integration also allows for easy tracking of payroll expenses. This feature is vital for accurate financial reporting.

Regions Supported

The payroll feature in Zoho Books is available in specific regions. Currently, Zoho Payroll supports only a few countries. These include:

- United States

- India

- Canada

Businesses in these regions can fully utilize the payroll features. Zoho is working to expand its payroll services to more countries. Keep an eye on updates for new region inclusions.

For businesses outside these regions, Zoho Books offers third-party payroll integrations. This helps manage payroll operations effectively. Check the available integrations in your country for a smooth experience.

Setting Up Payroll

Setting up payroll in Zoho Books can streamline your business operations. Ensuring that employees are paid accurately and on time is crucial. With Zoho Books, you can integrate payroll with your accounting seamlessly. Let’s explore how to set up payroll effectively.

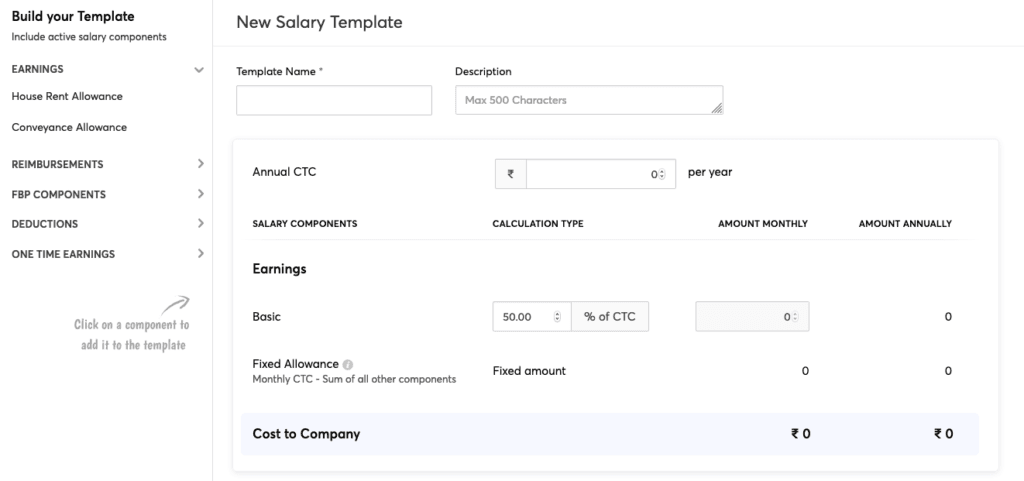

Initial Configuration

Begin by accessing the payroll section in Zoho Books. Navigate to the settings menu. Here, you’ll find options to configure payroll. First, enter your business details. This includes your company name and address. Next, input your tax information. Ensure all details are accurate to avoid issues later.

After entering basic details, set up your pay schedule. Decide if employees will be paid weekly, biweekly, or monthly. Input the start date for the payroll cycle. This ensures that employees know when to expect their payments.

Integration With Accounting

Zoho Books allows easy integration of payroll with accounting. Link your payroll expenses directly with your general ledger. This keeps your financial records accurate and up to date. To integrate, select the accounting section under payroll settings. Choose the relevant accounts for wages, taxes, and benefits.

Automating payroll entries reduces manual errors. It also saves time during financial reporting. Make sure your payroll settings align with your accounting practices. This will ensure smooth financial management.

Setting up payroll in Zoho Books is straightforward. With proper configuration, you can manage payroll efficiently. Keep your employees satisfied with timely and accurate payments.

Credit: www.zoho.com

Managing Employees

Zoho Books includes payroll features for managing employees. This tool helps with tracking work hours and processing salaries easily. Effortlessly handle employee benefits and tax calculations.

Managing employees in Zoho Books is efficient and straightforward. This software simplifies employee management tasks, making it easier for businesses to stay organized. With features like adding employee details and tracking employee time, Zoho Books ensures your payroll process runs smoothly.

Adding Employee Details

Adding employee details in Zoho Books is simple. Follow these steps to ensure all necessary information is captured:

- Navigate to the ‘Employees’ section in Zoho Books.

- Click on ‘Add Employee’.

- Enter the employee’s name, address, and contact details.

- Include their job title and department.

- Save the details to update the employee record.

Having accurate employee details helps in efficient payroll management. Ensure every field is filled out correctly to avoid errors.

Tracking Employee Time

Tracking employee time is crucial for accurate payroll. Zoho Books offers time tracking features that are easy to use:

- Employees can log their hours worked directly into the system.

- Managers can approve or reject the logged hours.

- The system automatically calculates total hours and overtime.

- Track time by project to ensure proper allocation of resources.

This feature helps in maintaining accurate timesheets and ensures employees are paid correctly.

| Feature | Description |

|---|---|

| Employee Details | Store personal and job-related information. |

| Time Tracking | Log and approve employee work hours. |

Manage your employees efficiently with Zoho Books. Keep their details updated and track their time accurately.

“`

Processing Payroll

Processing payroll can be a complex task for many businesses. Zoho Books simplifies this with its efficient payroll features. You can ensure that employees are paid accurately and on time. Let’s explore the key aspects of processing payroll in Zoho Books.

Running Payroll Cycles

Running payroll cycles in Zoho Books is straightforward. The software allows you to set up and manage different payroll cycles. You can choose weekly, bi-weekly, or monthly pay periods. This flexibility helps cater to various business needs.

Once the payroll cycle is set, you can easily run payroll. Zoho Books calculates the total earnings for each employee. It also considers any overtime or bonuses. The system ensures that all calculations are accurate and error-free.

Handling Deductions And Benefits

Deductions and benefits are an important part of payroll processing. Zoho Books helps manage these with ease. You can set up various deductions, such as taxes and health insurance. The software automatically applies these deductions to each paycheck.

Benefits can also be managed efficiently. You can add and track different benefits, like retirement plans or paid time off. Zoho Books ensures that all employee contributions are accurately recorded. This helps maintain transparency and compliance.

Credit: www.youtube.com

Compliance And Reporting

Compliance and reporting are crucial aspects of managing payroll. Ensuring all payroll processes adhere to legal standards protects your business. It also ensures employees receive accurate and timely payments. Zoho Books provides features that help with tax compliance and generating payroll reports.

Tax Compliance

Zoho Books makes tax compliance easier for businesses. It automatically calculates payroll taxes. This saves time and reduces errors. The software updates tax rates regularly. This ensures you are always compliant with the latest regulations. You can also set up tax rules specific to your region. This flexibility is essential for accurate tax calculations.

Generating Payroll Reports

Generating payroll reports is simple with Zoho Books. The software offers various report templates. These templates cover different aspects of payroll. For instance, you can generate reports on employee earnings. You can also create reports on tax deductions. These reports are customizable. You can include the data that matters most to your business.

Reports in Zoho Books are easy to understand. They present data in a clear format. This makes it easier to analyze payroll trends. You can also export these reports. This is useful for sharing information with accountants or other stakeholders.

Third-party Integrations

Zoho Books is a comprehensive accounting software. It offers many features to streamline business operations. One key aspect is its ability to integrate with third-party applications. These integrations enhance functionality and offer more options to users. A notable area of integration is payroll.

Popular Payroll Integrations

Zoho Books supports various popular payroll services. These integrations help manage employee salaries efficiently. For instance, the software can sync with Gusto. Gusto is a well-known payroll provider. It helps automate payroll tasks and manage employee benefits.

Another popular integration is with Paychex. Paychex offers robust payroll processing features. This includes tax calculation and filing. Integrating Paychex with Zoho Books ensures accuracy and saves time.

Zoho Books also integrates with SurePayroll. SurePayroll is known for its easy-to-use interface. It simplifies payroll management for small businesses. These integrations ensure that payroll processing is smooth and error-free.

Advantages Of Integrations

Integrating third-party payroll services with Zoho Books has many benefits. First, it reduces manual data entry. This minimizes errors and saves time. Automated data syncing ensures accuracy in payroll processing.

Second, these integrations offer real-time updates. Any changes in payroll data reflect instantly in Zoho Books. This keeps financial records up-to-date and accurate. Real-time updates are crucial for timely decision-making.

Third, these integrations provide a centralized platform. Businesses can manage accounting and payroll in one place. This simplifies operations and improves efficiency. A centralized system reduces the need for multiple software solutions.

Finally, integrations with popular payroll services ensure compliance. These services stay updated with tax laws and regulations. This ensures that businesses meet legal requirements. Compliance reduces the risk of penalties and fines.

Support And Resources

When using Zoho Books for managing finances, having access to robust support and resources is crucial. Zoho Books offers a range of tools to help users navigate its features, including payroll. This section will explore the various resources available to ensure a smooth experience.

Help Center Resources

The Zoho Books Help Center is a comprehensive library of articles and guides. Users can find detailed instructions on using payroll features. The Help Center is organized by topics, making it easy to find relevant information.

- Step-by-step guides

- Video tutorials

- FAQs

These resources are updated regularly to cover new features and updates.

Community And Expert Assistance

For more personalized support, the Zoho Books community is a valuable resource. Users can ask questions and share experiences with other users. This peer-to-peer support can provide insights and solutions that are not available in the Help Center.

Additionally, Zoho Books offers expert assistance through its customer support team. Users can reach out via:

- Live chat

- Phone support

This ensures that any issues or questions can be resolved quickly.

Frequently Asked Questions

Does Zoho Books Include Payroll Features?

No, Zoho Books does not include payroll features. Zoho Books is primarily focused on accounting. For payroll, you need Zoho Payroll.

How To Integrate Payroll With Zoho Books?

You can integrate Zoho Payroll with Zoho Books. This allows seamless transfer of payroll expenses. Set up the integration through the Zoho Books settings.

Is Zoho Payroll A Separate Product?

Yes, Zoho Payroll is a separate product. It is designed specifically for payroll management. You can subscribe to it separately from Zoho Books.

Can Zoho Books Track Employee Expenses?

Yes, Zoho Books can track employee expenses. However, it is not a full payroll solution. For comprehensive payroll management, use Zoho Payroll.

Conclusion

Zoho Books does not have built-in payroll features. Businesses need payroll solutions. Integrate Zoho Books with payroll software for seamless management. This helps streamline accounting and payroll processes. Many third-party payroll options work well with Zoho Books. Evaluate these options to find the best fit.

Always consider your business needs and budget. Zoho Books remains a strong accounting tool. Use integrations to cover payroll needs efficiently. This approach ensures smooth operations.